J-Perk 5.03 serial key or number

J-Perk 5.03 serial key or number

PMC

Jianhui Jian

aSchool of Economics and Management, North China Electric Power University, 2#, Beinong Road, Changping District, Beijing, , China

Huaqian Li

aSchool of Economics and Management, North China Electric Power University, 2#, Beinong Road, Changping District, Beijing, , China

Leah Meng

bSchool of Accounting, Curtin University, Hayman Road, Bentley Perth, Western Australia,, Australia

Chunxiang Zhao

cSchool of Accounting, Zhongnan University of Economics and Law. # Nanhu Avenue, East Lake High-tech Development Zone, Wuhan, , China

Abstract

This paper explores the effect of policy burdens of China&#x;s state-owned enterprises (SOEs) on senior executives&#x; excessive perks. The empirical analysis demonstrates that SOE policy burdens are significantly and positively correlated with senior executives&#x; excessive perks, indicating that SOE policy burdens increase agency cost. The results hold after controlling for potential endogeneity. Moreover, we find the following evidences. Strategic policy burdens of SOEs have a significantly greater impact on their senior executives&#x; excessive perks, compared with social policy burdens. The positive impact of SOE policy burdens on excessive perks is significantly weaker in east China due to the higher degree of marketization. The central government&#x;s stricter supervision can also alleviate the positive correlation between policy burdens of centrally administered SOEs and senior executives&#x; excessive perks.

1. Introduction

In recent years, there has been a series of events where managers of China&#x;s listed companies, especially state-owned enterprises (SOEs), abusing managerial power in their own interests at the firm&#x;s cost. Chinese media has exposed a number of listed companies, such as China Railway Construction Corporation and Zhuhai Gree Group, spending staggering amount of money on top managers&#x; entertainment. A major stream of research investigates the causes of SOE senior executives&#x; perk consumption from such aspects as the agency cost (Jensen and Meckling, ; Hart, ), internal and external governance mechanisms (Brickley and James, ; Yermack, ; Grinstein et al., ), and management incentives (Rajan and Wulf, ). However, there has been little research to examine the effect of policy burdens on the senior executives&#x; perks under the socialist economy.

We are motivated to examine SOE policy burdens and senior executives&#x; perks in China for the following reasons. Firstly, during the process of national economic development, most Chinese SOEs bear policy burdens imposed by the government (Lin et al., ), including strategic policy burdens and the social policy burdens (Lin and Tan, ). For example, the government directs SOEs to develop national strategic industries, regarding energy, communications and transportation etc. Besides, SOEs are required by the government to recruit redundant staff and not to lay off workers for the maintenance of social stability (Lin and Li, ). The policy burdens serve as a means by which the government intervenes in the economy (Li, ). It is therefore difficult for the government to distinguish losses induced by policy burdens from those of SOEs&#x; poor managerial performance. This challenge worsens information asymmetry and in turn, increases agency cost which causes soft budget constraints, rent seeking, the moral hazard, managerial slacks, and corruption (Kornai, ; Lin and Li, ; Ting and Huang, ; Fang et al., ; Guo, ; Zhao et al., ; Yu and Lee, ). These issues constitute the political cost incurred by SOE policy burdens. Research on the association between SOE policy burdens and excessive perks of senior executives could shed light on the political cost.

Secondly, it has been a focus of public concern in China that SOE senior executives consume perks for their own interests. Large consumption of perks could do harm to firm value. For example, in , the annual accounting report of China Railway Construction Corporation, a large SOE engaged in railway construction, exposed an enormous sum of perks among which the entertainment expense reached $ million, accounting for nearly 10% of the company&#x;s net profit that year. In addition, Chinese media reveal that managers of Sinopec&#x;s Guangdong Petroleum Branch and Zhuhai Gree Group consumed a large quantity of luxurious liquor. Atkinson and Stiglitz () suggest that Chinese SOE managers are more likely to spend ludicrously on such things as food, clothing, housing, transportation, and entertainment at the company&#x;s expense. Some studies estimate perks can amount to 15%&#x;32% of total executive compensation (Kato and Long, ). Therefore, it is of great practical significance to study the perks of SOE executives.

Our objective in this paper is to examine whether policy burdens imposed on SOEs is associated with firms&#x; aberrant perks. Based on a sample of listed SOEs over &#x; period ( firm-year observations), we demonstrate that SOE policy burdens are significantly and positively associate with excessive managerial perks. We conduct robustness tests to mitigate the negative influence of endogeneity and find their results remain qualitatively robust. The further analysis suggests that strategic policy burdens of SOEs have stronger positive correlation with excessive perks than social policy burdens do. Additionally, the positive correlation between policy burdens and excessive perks is significantly weaker in eastern coastal provinces of China due to the higher degree of marketization. It is significantly mitigated in centrally administered SOEs (CSOEs) as they are subject to stricter supervision of Chinese central government.

Our paper makes the following contributions. Firstly, this paper enriches the literature on the economic consequences of SOE policy burdens. Extant research finds that SOE policy burdens have a significant influence on soft budget constraints (Kornai, ; Lin and Li, ; Li, ), financing and investment decision making (Chen et al., ; Bai and Lian, ; Hao and Lu, ; Zhan et al., ), corporate performance (Liao et al., ; Sun and Liu, ), and executives&#x; political promotion (Liu et al., ; Feng and Johansson, ; Xin et al., ). We find significantly positive impact of SOE policy burdens on senior executives&#x; excessive perks. Further, we find that compared with social policy burdens, strategic policy burdens have significantly stronger positive correlation with excessive perks. It provides enlightenment for the further research and valuable insights to policymakers and regulators not only in China, but in other countries concerning policy burdens.

Secondly, we add to the literature related to perks. Previous studies generally attribute managers&#x; perks to their agency behavior (Jensen and Meckling, ; Hart, ; Yermack, ), internal corporate governance mechanism (Brickley and James (); Claessens et al. (); Andrews et al. (), external supervision (Yermack (); Bushee et al. (); Andrews et al., ) and insufficient compensation incentives (Rajan and Wulf, ; Marino and Zabojnik, ; Kato and Long, ; Adithipyangkul et al., ). We further this direction of research from a new perspective. In addition, existing research regards perks as a whole, which gives rise to two competing views of perk consumption. The first view argues that perks are a tool for senior managers to misappropriate a firm&#x;s surplus (Jensen and Meckling, ; Hart, ; Yermack, ). The alternative view is that perks can be an incentive in an optimal employment contract to motivate employees (Fama, ; Rajan and Wulf, ). However, it indicates that managerial perks can be a result of both agency costs and nonmonetary incentives (Cai et al., ). In our study, we follow Luo et al. () to separate senior executives&#x; excessive perks and examine its relationship with SOE policy burdens, which thus enriches the research on perk consumption.

The rest of the paper is organized as follows. Section 2 is the literature review. Section 3 analyzes the institutional background. We present hypothesis development in section 4. The data selection procedures, methodology and empirical results are included in Section 5, and Section 6 concludes our study.

2. Literature review

Research on managerial perks

It&#x;s widely acknowledged that the consumption of perks by senior executives is a sign of agency problems. Jensen and Meckling () point out, due to the separation of ownership and management, managers tend to seek perks by misappropriating corporate resources, which is detrimental to the firm value. Large consumption of perks could be incurred in the businesses where their managerial ownership is small and corporate governance is weak. The consumption of perks is more likely to be found in mature companies which possess less growth opportunities but more cash flow (Grossman and Hart, ; Jensen, ). Likewise, Hart () proves that perks are derived from executives&#x; exploitation of the corporate resources in their own interests. Subsequent research finds that senior executives&#x; perk consumption has negative influence on the enterprises. It could foster low morale, drastically reducing corporate performance (Yermack, ). Managerial perks are associated with poor accounting disclosures (Gul et al., ). Moreover, the weaker the corporate governance, the more perks CEOs consume (Andrews et al., ).

In light of the view that perks are agency cost, further research examines the association between governance mechanisms and perks. Brickley and James () find that the managerial perk consumption could be restrained, if managerial discretions are checked by independent directors. Institutional investors could be another factor to influence the agency cost. High institutional ownership could reduce perks consumed by CEOs (Claessens et al., ). It is further supported by Chen et al. () who find the diversified large shareholders could result in lower perks consumed by managers. Firms with foreign ownership discourage excessive perk consumption. Conversely, the consumption of perks could be encouraged in firms with weak corporate governance (Andrews et al., ). Luo et al. () find high corporate shareholding proportion of the banks leads to big CEO perks. Ting and Huang () find that greater perks could be incurred by CEOs with more power in the board of directors.

Besides the internal governance mechanisms, there are a number of external monitoring mechanisms that can work effectively to restrain the managerial perk consumption. First, audit quality of accounting firms could influence consumption of managerial perks (Yermack, ). Second, media exposure can provide strong external governing pressure on managerial perks (Bushee et al., ). Dai et al. () find that local newspapers can report enterprises&#x; illegal behaviors earlier and faster, which has a more effective constraint on the perks. Third, enhanced SEC disclosure requirements impose greater pressure on managerial perks. Grinstein et al. () find evidence that CEO who used to enjoy abnormally high compensation reduced or eliminated perks after SEC tightened the disclosure requirements on executive compensation in Fourth, the implementation of the political and economic system reform alleviates the consumption of managerial perks. Xin and Tan () find that China&#x;s market-oriented reform may reduce the perks of SOEs&#x; senior executives. Fang et al. () discover that the perks used to build political rapport declined after the 18th National Congress of the Chinese Communist Party, or after the anti-corruption campaign. However, CEOs, especially of centrally administered SOEs in China, who subject to pay restrictions imposed by Chinese central government, make more perk consumption in their own interest (Bae et al., ).

In contrast, perks are not necessarily to the detriment of shareholders. Instead, it can be used to stimulate productivity (Rajan and Wulf, ). Perks may serve as a component of a complex compensation package to motivate employees to work harder and thus may actually increase firm value (Fama, ). Marino and Zabojnik () find that more perks would be awarded in firms in more uncertain production environments and firms with better corporate governance. Company owners may allow their managers&#x; discretion in consumption of certain perks such as entertainment, dining, traveling, etc.(Zhang et al., ), especially when the monetary compensation of executives is low (Zhao, ). Further, evidence of perks as managerial incentives in Chinese enterprises has been confirmed in some research. It&#x;s been a traditional compensation treatment under Chinese corporate culture to provide non-cash perks (Kato and Long, ; Chen et al., ; Luo et al., ). Adithipyangkul et al. () find that owing to the Chinese institutional background, the existence of pay restriction and government administrative intervention makes listed companies more inclined to use perks to replace monetary compensation to motivate managers.

Research on the economic consequences of policy burdens

It&#x;s a general practice in China that the government imposes policy burdens on SOEs (Lin et al., ; Lin and Tan, ). The existing literature finds that policy burdens negatively impact SOE operational decisions and corporate performance. Policy burdens may lead to investment inefficiency (Shleifer and Vishny, ; Chen et al., ; Bai and Lian, ; Hao and Lu, ). Similarly, Zhao () finds that political connections lead to low investment efficiency. Besides, policy burdens SOEs undertake may increase the stickiness of costs (Liao et al., ) and reduce their corporate performance (Liao et al., ; Sun and Liu, ).

In order to mitigate the negative influence of SOE policy burdens, Chinese government offers economic support to SOEs. Kornai () points out that when the market competition reaches a certain degree, the policy burdens inevitably bring the soft budget constraint to SOEs, which has no bearing on the public ownership of enterprises (Li, ; Lin and Li, ). Shleifer and Vishny () find that local governments will support local loss-making enterprises through mergers and acquisitions because of their reliance on transmitting policy burdens to these companies. Moreover, the government will help enterprises acquire various resources and preferential policies (Lin et al., ; Li et al., ) and Faccio () finds that politically connected firms are more likely to have higher bank loan ratios, more favorable tax rates, and higher market share.

Besides the economic support, Chinese government provides political promotion of SOE senior executives to motivate them to undertake policy burdens. Liu et al. () indicate that executives are more likely to obtain political promotion when there is a high degree of government intervention and high unemployment in the region where the company is located. As a result, SOE executives endeavor to get promoted by assuming policy burdens (Feng and Johansson, ; Xin et al., ).

Literature analysis

First, the existing literature has not studied managerial perks from the perspective of SOE policy burdens. In fact, as a kind of government intervention in the economy, policy burdens drive the enterprises to deviate from the primary goal of value maximization, alleviate the governance of market competitiveness and increase information asymmetry. It is difficult for the government to evaluate managers&#x; performance and administrate performance-based incentives. SOE executives are more likely to consume big perks in their own interest.

Second, the existing literature has two competing views of perks derived from incentive theory and agency theory respectively. To some extent, the two views are reasonable. In fact, perks are complicated expenses, including some incurred by senior executives&#x; agency behaviors and the others by non-monetary incentives (Cai et al., ). However, most of the research do not distinguish between reasonable incentive component and the excessive perks, which reduces the validity of those research. Therefore, we separate the excessive part from SOE senior executives&#x; perks and examine its association with policy burdens.

3. Institutional background

In China, SOEs have been an important means for the government to carry out the catch-up development strategy and promote the development of national economy (Lin et al., ). In s, Chinese government realized that in order to transform China from an underdeveloped agricultural country into a developed industrial one, it had to establish an independent and complete industrial system. The key foundation is heavy industry. Therefore, since the first five-year plan, Chinese government has given priority to the development of heavy industry, and the subsequent five-year plans follow this development strategy. The heavy industry normally requires decades to develop with huge investment. However, as an underdeveloped agricultural country, China featured scarce capital and sufficient labor. It violated the theory of comparative advantage to develop heavy industry. Thus, private enterprises were unwilling to invest in heavy industry. SOEs were then required to prioritize the development of heavy industry, which is strategic policy burdens (Lin and Tan, ). The imbalanced industry development strategy couldn&#x;t ensure enough jobs for urban residents, which negatively impact social stability. In order to provide sufficient job positions, the government asked SOEs to hire as many workers as possible. That is SOE social policy burdens. When reform and opening-up began in , SOEs dominated China&#x;s industrial sectors. SOEs&#x; share in China&#x;s total industrial output was % in Until , SOEs still employed % of urban residents and possessed % of total investment in industrial fixed assets (Lin et al., ).

Since s, SOEs have experienced many market-oriented reforms, which aim to enhance the vitality of enterprises, separate government from enterprise administration and expand SOEs&#x; operating rights. But SOEs still serve as a tool of Chinese government to make up for market defects and consolidate the foundation of the socialist economic system, which gives them a leading role in the national economy. The Decision of the Fourth Plenary Session of the 15th Central Committee states that state-owned economy should control industries and sectors which play an important role in national economic security, such as energy, communications, transportation and high-tech industry. The report of the 18th National Congress of the Communist Party of China (CPC) states that We must unswervingly consolidate and develop the state-owned economy. We will promote more investment of state-owned capital in important industries and key areas that are vital to national security and the lifeblood of the national economy, and continuously enhance the vitality, control and influence of the state-owned economy. SOEs are an important force in ensuring the implementation of the primary national strategies, promoting economic and social development, and enhancing overall national strength. Thus, SOEs bear certain economic, political, and social responsibilities.

In addition, the Chinese government implemented a series of political decentralization reform. In order to stimulate the local governments to increase economic growth, the central government has gradually delegated the local governments&#x; policy-making power and administrative responsibilities (Zhang, ). At the same time, Chinese central government evaluates local officials based on a tournament incentive mechanism that political promotion is linked with local economic development (Vo, ). The pursuit of local economic development makes local governments to impose development tasks on SOEs within their jurisdiction, such as increasing GDP, securing employment, raising fiscal revenues, and providing cheap public goods, which also increases the policy burdens of SOEs.

4. Hypothesis development

Managers can take advantage of insider knowledge for personal gains at the expense of shareholders due to information asymmetry between owners and managers (Jensen and Meckling, ; Grossman and Hart, ). Many scholars believe competitive market mechanism can alleviate the aforementioned agency problems (Megginson and Netter, ). On the one hand, the competitiveness mechanism in the product market could mitigate information asymmetry between managers and owners. The profit status of an industry is public information in a fully competitive market. Shareholders can assess a manager&#x;s performance by comparing with the actual profit status of the company (Stigler and Friedland, ). Such public information also enables shareholders to structure a manager&#x;s remuneration package based on their performance comparison, and therefore, discourage shirking and opportunistic behaviors (Grossman and Hart, ; Gupta et al., ). On the other hand, the competitive manager market could restrain the agency behaviors of executives by means of its reputation mechanism. Fama () argues that in a competitive manager market, managers are self-conscious about their performance record and will constantly seek market rewards. Competent managers will be hired with high salaries, and the rewards offered by their employers will be equivalent to the value of managers&#x; human capital. Therefore, managers must work hard to improve their reputation and value in order to improve their future reward (Fee et al., ).

However, policy burdens could mitigate the governance of competitive market mechanism on SOE senior executives&#x; agency behaviors. SOEs undertake both strategic policy burdens and social policy burdens. The former drives SOEs to invest in capital-intensive industries, which violates the theory of comparative advantage. The latter keeps SOEs overstaffed for social stability. Such social policy burdens have greatly increased labor costs and make them less competitive in the market. In return, the Chinese government lends a hand to SOEs. For example, commercial banks are required to make loans to SOEs with low interest rates (Faccio, ; Li et al., ). The government supports SOEs in mergers and acquisitions to increase market shares (Shleifer and Vishny, ). And SOEs could acquire cheap raw material and preferential tax policies, which reduce their operation cost (Faccio, ; Lin and Li, ). Therefore, SOEs&#x; performance is not only influenced by market competitiveness but also by policy burdens and government support. It is not reasonable to assess managerial performance by comparing SOE performance with that of their counterparts.

In addition, SOE policy burdens increase information asymmetry between Chinese government and SOEs, which also make it difficult to evaluate SOEs&#x; managerial performance. First, policy burdens hinder the improvement of corporate value to some extent. As such, SOE managers will take advantage of the information asymmetry and rationally choose to release information beneficial to themselves in order to secure more capital and resource support from the government. This enhances information asymmetry. Second, the policy burdens expand and complicate SOEs&#x; business and managerial activity (Lin and Li, ). For example, local government often assigns SOEs poverty alleviation tasks such as local infrastructure work and public service. In the recent combat to the COVID epidemic, SOEs are explicitly required by Chinese State Council to expand the recruitment of graduates for two consecutive years. It worsens information asymmetry between the government and SOEs.

As such, SOE executives&#x; compensation contract based on economic performance has lost its incentive function. In recent years, the Chinese government has issued a series of regulations to impose pay ceiling and restrain executive compensation. On September 16, , six central government ministries jointly issued the Guidance on Further Regulating the Compensation System for Persons in Charge of CSOEs. On August 29, , Politburo of the CPC Central Committee reviewed and approved the Reform Plan for the Compensation System for Persons in Charge of CSOEs. The pay cap has led to an overall decline in SOE managers&#x; monetary compensation. Compared with mangers in the private sectors, the average salary of executives in SOEs is much lower, which may motivate SOE managers to seek excessive perks to make up for the loss in the monetary compensation. The reasoning above leads to the following hypothesis.

There is a positive association between policy burdens and excessive managerial perks in SOEs.

5. Empirical analysis

Data and sample selection

Our analysis is made based on a sample of the China&#x;s SOEs listed on Shanghai and Shenzhen Stock Exchanges over the period from to Corporate accounting data are obtained from China Stock Market and Accounting Research (CSMAR) database. Data regarding corporate registration location come from Wind financial database. Besides, we hand collect the data in respect to managerial perks and controlling chain hierarchy from annual accounting reports. For the purpose of our study, we eliminated the following observations: (1) financial and insurance listed companies due to their business differing from other firms; (2) firms in the year of its initial public offering; (3) firms with abnormal financial data; (4) firms with incomplete data; (5) firms whose stock is designated Special Treatment . This leaves a sample of observations. To limit extreme values, all continuous variables are winsorized at level 1% and 99%. We adopt the industry categorization standard of China Securities Regulatory Commission in and obtain 21 industries, with the manufacturing industry further divided into subcategories and the other industries classified according to the general category.

Research design

Baseline regression model

To examine the relationship between SOE policy burdens and senior executives&#x; excessive perks (H1), we specify a model for our main analysis as follows:

Dependent variable

We construct ExPerk as the dependent variable in model (1) representing SOE senior executives&#x; excessive perks. Perks refer to the extra benefits besides compensation obtained by senior executives. They are considered as a kind of agency cost (Jensen and Meckling, ; Grossman and Hart, ; Yermack, ). However, Rajan and Wulf () argue perks can be used to stimulate productivity. Cai et al. () propose that perks are complicated expenses, including reasonable perks derived from non-monetary incentives, and excessive perks resulted from senior executives&#x; agency behaviors. This paper aims to examine the influence of SOE policy burdens on agency cost. Therefore, we set excessive perks as dependent variable in model (1).

We take two steps to estimate excessive perks. Firstly, data of SOE senior executives&#x; perks are drawn from the footnotes of cash flow statements. According to China Accounting Standards, both direct and indirect cash payment resulted from major operating activities should be disclosed under other cash payment related to operating activities in the cash flow statement. Chen et al. () regard the following expenses as perks such as office expenses, travel expenses, business entertainment expenses, communications expenses, overseas training expenses, vehicle expenses and conference fees. We hand-collect data regarding such categories from the footnotes of other cash payment related to operating activities for perks. Secondly, we follow Luo et al. () to estimate excessive levels of payment for perks of each firm. In model (2), firm characteristics can be used to estimate the normal level of perk payment for each industry within each year. We then calculate the positive residual of model (2) considered as excessive perks.

where refers to the payment for perks of firm i in year t obtained from the footnotes under other cash payment related to operating activities ; is the value of total assets of firm i in year t-1; is the difference between sales revenue of firm i in year t and that of year t-1; is the book value of fixed assets of firm i in year t; is the book value of inventory of firm i in year t; is natural logarithm of the sum of corporate employees in firm i and in year t.

Independent variables and control variables

Following Lin and Li (), we employ the deviation of SOEs&#x; actual capital-labor ratio (total assets/number of staff) from its optimal value to measure SOE policy burdens. The capital-labor ratio turns higher when SOEs invest in capital-intensive industries whereas it becomes lower when SOEs assume many social functions such as redundant employment. We estimate the optimal value of capital-labor ratio in model (3). The negative residual values suggest that SOEs bear social policy burdens (Burden1), measured by the absolute value of the negative residual values. The positive residual values indicate that SOEs bear strategic policy burdens (Burden2). SOE policy burdens (Burden) are measured by the sum of Burden1 and Burden2.

In model(3), represents capital-labor ratio of firm i in year t. is natural logarithm of total assets of firm i in year t-1; is asset-liability ratio of firm i in year t is return on total assets of firm i in year t-1; is the growth rate of sales revenue of firm i in year t is the ratio of tangible assets to total assets of firm i in year t Zone, Year and Industry are dummy variables for the province, year and industry.

Because some firm characteristics exert much effect on senior executives&#x; perks (Chen et al., ; Luo et al., ; Ting and Huang, ; Zhang et al., ; Andrews et al., ), we add control variables concerning firm characteristics in model (1) as specified in Table 1 .

Table 1

Variable definitions.

| Variable | Definition |

|---|---|

| ExPerk | Excessive perks measured by the positive residual in model (2) |

| Burden | Policy burdens measured by the sum of Burden1 and Burden2 |

| Burden1 | Social policy burdens measured by the absolute value of negative residual in model (3) |

| Burden2 | Strategic policy burdens measured by the positive residual in model (3); |

| Asset | Natural logarithm of total assets |

| Lev | Asset-liability ratio |

| NCF | Ratio of net operating cash flow to total assets |

| ROA | Return on total assets |

| Dual | A dummy variable equals 1 if CEO is also board chairman and otherwise 0 |

| Tenure | CEO tenure |

| Age | CEO age |

| Gender | A dummy variable equals 1 if CEO is male and otherwise 0 |

| LnShr | Natural logarithm of the quantity of senior executive&#x;s shares |

| Independent | Ratio of the number of independent directors to that of the board of directors |

| Direct | Number of the board of directors |

| Executive | Number of top management |

| HHI | Herfindal index of top ten shareholders |

Empirical results

Summary statistics

Table 2 reports summary statistics for the variables. There is slight difference between the mean and median value of each continuous variable, indicating that they conform to the normal distribution. The mean value of ExPerk is , with a maximum of , indicating that senior executives&#x; excessive perks are high in China&#x;s SOEs. The mean value of Burden, Burden1 and Burden2 is , and respectively, suggesting that policy burdens are prevalent in SOEs. The Burden has a standard deviation of , with a maximum of , suggesting that SOEs bear rather heavy policy burdens. The mean value of Tenure of SOEs is years, with the longest tenure up to 17 years. The mean value of LnShr is and its median is , indicating that insufficient equity incentive for SOE executives may lead to more perks used to satisfy their own needs. The ratio of Independent is on average, and has a standard deviation of This is because China&#x;s Listed Companies Corporate Governance Standards stipulate that the proportion of independent directors on the board of directors of listed companies should not be less than one third. The overwhelming majority of firms employ independent directors in order to meet the requirements of relevant regulations. The median of Executive is 7 and the largest reaches 15, indicating that top management are overstaffing in some SOEs. The HHI ranges from to , indicating that the ownership concentration varies among SOEs. This can be led to by the introduction of non-state-owned shareholders in recent years due to the mixed ownership reform, decentralizing SOE ownership to some extent.

Table 2

Descriptive statistics.

| Variable | N | Mean | Sd | P50 | Min | Max |

|---|---|---|---|---|---|---|

| ExPerk | ||||||

| Burden | ||||||

| Burden1 | ||||||

| Burden2 | ||||||

| Asset | ||||||

| Lev | ||||||

| NCF | &#x; | |||||

| ROA | &#x; | |||||

| Dual | 0 | 0 | 1 | |||

| Tenure | 5 | 1 | 17 | |||

| Age | 50 | 32 | 67 | |||

| Gender | 1 | 0 | 1 | |||

| LnShr | ||||||

| Independent | ||||||

| Direct | 9 | 4 | 16 | |||

| Executive | 7 | 2 | 15 | |||

| HHI |

Correlation analysis

Table 3 presents the Pearson pairwise correlation results. The coefficients for the correlation of the independent variables and the control variables are small. In addition, we compute variance inflation factors (VIFs) when estimating our regression model. Overall, we observe that no VIFs exceed five, so multi-collinearity is not serious in our study. The coefficient for the correlation between ExPerk and Burden is significantly positive, implying the positive relationship between SOE policy burdens and senior executives&#x; excessive perks. ExPerk has a significant negative correlation with Asset, indicating that excessive perks of large-scale SOEs are relatively low. It could be because centrally administered SOEs are large in scale but subject to strict supervision, which leads to lower agency cost. ExPerk is significantly negatively related with Lev, indicating that liabilities play a certain role in corporate governance. ExPerk has significantly positive relationship with NCF and ROA. It suggests excessive perks are prevalent in firms with large cash reserve and higher profit or return on assets. ExPerk is significantly positively related with Dual and Tenure, indicating that the more power a manager possesses or the longer he holds office, the more excessive perks occur. A significantly positive correlation is also found between ExPerk and Age. Executives approaching retirement are more likely to pursue a life of pleasure because retirement means losing job-related benefits. However, ExPerk is significantly negatively correlated with Direct and HHI. It suggests that big size of the board and highly concentrated ownership associates may suppress excessive managerial perks.

Table 3

Pearson correlation coefficients.

| ExPerk | Burden | Asset | Lev | NCF | ROA | Dual | Tenure | Age | Gender | LnShr | Independent | Direct | Executive | HHI | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ExPerk | 1 | ||||||||||||||

| Burden | &#x;&#x;&#x; | 1 | |||||||||||||

| Asset | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | 1 | ||||||||||||

| Lev | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | 1 | |||||||||||

| NCF | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | 1 | ||||||||||

| ROA | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | 1 | |||||||||

| Dual | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x; | &#x;&#x; | 1 | ||||||||

| Tenure | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | 1 | |||||||

| Age | &#x;&#x; | &#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | 1 | ||||||

| Gender | &#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x; | &#x; | &#x; | &#x;&#x;&#x; | 1 | ||||||

| LnShr | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | 1 | |||||

| Independent | &#x; | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x; | &#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | 1 | |||

| Direct | &#x;&#x;&#x;&#x; | &#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x;&#x; | 1 | ||

| Executive | &#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | 1 | ||

| HHI | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x; | &#x;&#x;&#x;&#x; | &#x;&#x;&#x; | &#x;&#x;&#x; | 1 |

Baseline regression analysis

Table 4 presents the results of the main regression test. The first column shows that there is a significant positive correlation between policy burdens and SOE executives&#x; excessive perks. It indicates when SOEs bear more policy burdens, executives are more likely to take more excessive perks, suggesting a higher agency cost. It confirms our hypothesis 1 in this paper. SOE policy burdens bring negative impact on SOE performance while government support induced is beneficial to their performance. It leads to slight correlation between SOE corporate and managerial performance. It weakens the governance of market mechanism to alleviate information asymmetry between SOEs and governments. Thus, there has been a lot noise in the process of evaluating SOE executives&#x; performance, which makes it difficult to motivate executives by using pay-for-performance scheme. The governments, therefore, attempted to restrain SOE executives&#x; compensation. Currently, pay ceiling has been set to SOE executives&#x; compensation. Many SOE executives believe their remunerations are undervalued by the government and feel a sense of injustice. As a result, they are motivated to abuse their managerial power for perk consumption. The results in columns 2 and 3 show that coefficients of Burden1 and Burden2 are significantly positive, suggesting that both strategic and social policy burdens lead to more excessive perks.

Table 4

Baseline regression results.

| (1) | (2) | (3) | |

|---|---|---|---|

| ExPerk | ExPerk | ExPerk | |

| Burden | &#x;&#x;&#x; () | ||

| Burden1 | &#x;&#x;&#x; () | ||

| Burden2 | &#x;&#x;&#x; () | ||

| Asset | &#x;&#x;&#x;&#x; () | &#x;&#x;&#x;&#x; () | &#x;&#x;&#x;&#x; () |

| Lev | &#x; () | &#x; () | &#x; () |

| NCF | () | () | () |

| ROA | &#x;&#x;&#x; () | &#x;&#x;&#x; () | &#x;&#x;&#x; () |

| Dual | &#x; () | &#x;&#x;&#x; () | &#x;&#x; () |

| Tenure | () | () | () |

| Age | &#x; () | &#x;&#x;&#x; () | () |

| Gender | () | &#x;&#x; () | &#x; () |

| LnShr | &#x; () | &#x; () | &#x; () |

| Independent | &#x;&#x;&#x; () | &#x;&#x;&#x;&#x; () | &#x;&#x;&#x; () |

| Direct | &#x;&#x;&#x;&#x; () | &#x;&#x;&#x;&#x; () | &#x;&#x;&#x;&#x; () |

| Executive | () | &#x;&#x; () | () |

| HHI | &#x;&#x;&#x;&#x; () | &#x;&#x;&#x;&#x; () | &#x;&#x;&#x;&#x; () |

| Constant | &#x;&#x;&#x; () | &#x;&#x;&#x; () | &#x;&#x;&#x; () |

| Year | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| N | |||

| Adj.R2 | |||

| F |

ExPerk has significantly negative correlations with control variables such as Asset, Direct, Independent and HHI

2. J and L Retirement and Financial b Activation Code

3. J Maker AppearMenu serial

4. J Maker CountdownClock registration code

5. J Maker eChessboard serial

6. J Maker matchit serial

7. J Maker scrollup s/n

8. J Maker SlidingPuzzle s/n

9. J Maker TickLeft Serial

J Maker v serial number

J-Over serial

J-Over serz

J-Perk reg. code

J-Perk serial number

J-Perk reg. code

J-Perk Serial Number

J-Perk serial number

J-Perk serial number

J-Perk reg. code

J-Perk reg

J-Perk registration code

J-Perk Registration

J-Perk Serial

J-Perk Serial

J-Write Serial

J. Graffman Calendar Reg Code

J. Graffman Calendar serial number

manicapital.com registration key

Jaba Com Web Browser s/n

Jaba Com Web Browser reg

Jack The MP3 Ripper reg

Jack The MP3 Ripper s/n

Jack The MP3 Ripper Serial

Jack The MP3 Ripper s/n

Jack The MP3 Ripper serial key

Jack The MP3 Ripper v Reg Code

JackHammer serial

JackHammer s/n

JackHammer s/n

JackHammer serial

Jackpot Serial

Jackpot Pinball registration key

Jackpot Slots serial number

Jackpot Slots serial

JackPot Slots code

Jackpot Super Slots reg

Jackpot Super Slots s/n

Jacks Magic Pro serial key

Jacks Magic Pro s/n

Jacks Magic Pro S/N

Jacobs Image Browser reg. code

Jacob\'s Math Training serz

Jacob\'s Math Training registration code

jagged alliance wildfire bis reg

jahamuha1 reg. code

jaikoz build Key

Jailbreak Serial

Jam s/n

Jam 98 MP3 Playlist Maker activation key

Jam 98 MP3 Playlist Maker 22 Serial

Jambient s/n

JamBox s/n

James Bond Nightfire Activation Code

James Bond Nightfire serz

James Bond Nightfire serz

James Bond Nightfire ser/num

James Bond NightFire Registration

James Bond Nightfire serz

James Bond Nightfire reg. code

James Bond Nightfire-german serial number

James Gleick\'s Chaos Serial

Jammer Registration

Jammer reg

Jammer s/n

Jammer activation key

Jammer serz

Jammer serial number

Jammer SongMaker serial number

Jammin\' Racer registration key

Jammin\' Racer B s/n

Jammi\'n race activation key

JanssenWeb Risk activation key

JanssenWeb Risk key

JanssenWeb Risk activation key

JanssenWeb Risk serz

JanssenWeb Risk v ser/num

JanssenWeb Risk v code

Janus Controls Suite for .NET serz

Janus Controls Suite for .NET v ser/num

Janus GridEX b s/n

Janus GridEX ser/num

Janus GridEX Retail d Serial Number

Japanese Mosaic Puzzles registration key

Japanese Mosaic Puzzles Key

Japanese Mosaic Puzzles serial number

Japanese Mosaic Puzzles serial number

Japanese Mosaic Puzzles v ser/num

Japos Mouse Lens Serial

JarHelper serial number

JAS 95 Serial Number

JasFTP serial

JaSFtp s/n

JaSFtp s/n

Java Browser Activation Code

Java Builder Pro reg

Java Draw serial

Java Embedded Server Key

Java Safe s/n

Java Script It registration code

Java Script It Registration

Java Studio serz

Java Web Server reg. code

Java WorkShop Registration

Java WorkShop code

Java WorkShop reg

Java WorkShop key

JavaC Booster Key

JavaPC s/n

JavaScript Encoder serial key

JavaScript Maker Registration

JavaScript Maker activation key

JavaScript Maker key

JavaScript Scrambler code

JavaScript Scrambler Reg Code

Javix Visual Debugger build 3 registration key

Jaws pdf reg. code

Jaws PDF Creator serial

Jaws PDF Creator ser/num

Jaws PDF Creator key

Jaws PDF Creator ser/num

Jaws PDF Creator code

Jaws PDF Creator serial number

Jaws PDF Creator Registration

Jaws PDF Editor Activation Code

Jaws PDF Editor Activation Code

Jaws PDF Editor v serz

JayTrax b Registration

JayTrax serial

Jaytrax serz

JBall ser/num

JBlitz Professional Serial

JBlurb Pro activation key

JBlurb Pro activation key

JBlurb Professional Edition code

JBlurb Professional Edition code

JBUILDER Key

JBuilder ser/num

JBuilder Foundation serial

JBuilder Enterprise Key

JBuilder 9 9 Key

JBuilder Enterprise Activation Code

JBuilder JDatastore serial number

Jbuilder Pro ser/num

JC ActiveDoc serial

JC Spyware and Adware Remover serial number

JCanvas Studio Expert Edition s/n

JCheck RC1 serial

JCheck RC1 serial key

JCheck registration key

JCheck Beta 1 reg

JCheck Serial

JClass BWT s/n

JClass BWT serial key

JClass Chart serial number

JClass Chart ser/num

JClass Chart Bytecode j Activation Code

JClass DataSource activation key

JClass DataSource code

JClass DataSource ByteCode s/n

JClass Enterprise Suite Activation Code

JClass Enterprise Suite J JDK activation key

JClass Enterprise Suite K serial number

JClass Enterprise Suite Bytecode JDK J reg

JClass Enterprise Suite Source Code J JDK serz

JClass Enterprise Suite Source Code K JDK + reg. code

JClass Field Reg Code

JClass Field serial number

JClass Field Bytecode j key

JClass HiGrid activation key

JClass HiGrid activation key

JClass JarHelper Serial

JClass JarMaster K Activation Code

JClass LiveTable serial key

JClass LiveTable S/N

JClass LiveTable Bytecode j registration key

JClass PageLayout s/n

JClass PageLayout ByteCode JDK K Key

JClass Standard Suite registration key

JClass Swing Suite registration key

JCourier serial number

JCreator S/N

JCreator Pro s/n

JCreator Pro Activation Code

JCVGantt Pro serial

JD Tricks code

JD Tricks ser/num

JDBC Driver JC2 serial

JDBC Embedded SQLJ JC1 Reg Code

JDoc2CHM key

JDoc2CHM s/n

Cracks Gurus

Type your search in the box below. Add keygen at the end if you are looking for a serial key generator, add crack if you wanna find a crack, add serial is you are interested in viewing a serial number. Other possible words are: patch, license, regfile, keyile. Add nothing to find everyting we have in our cracksguru data base.

| Added to site | |

| Rating | 93/ |

| Votes | 9 |

manicapital.com ( bytes)

| name | size | compressed |

|---|---|---|

| manicapital.com | ||

| manicapital.com |

manicapital.com

The Cracking Answer proudly presents . ░ █░ █ ▒▒ ▒▒ █░ ▄ █▓▓░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▓▓█ ▄░ █ █▓▓▓▓▓▓▓▓▓▓▒▒▒▒▒▒░░░ a hIGH qUALITY tCA rELEASE ░░░▒▒▒▒▒▒▓▓▓▓▓▓▓▓▓▓█ █ ▀ █▓▓░▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀░▓▓█ ▀░ █ ▒▒ ▒▒ █░ █ ░ ░ █░ █ Program J-Perk Version █░ █ Cracker ScIpPeR Release Date 03/ █░ █ Supplier manicapital.com Protection sERIAL █░ █ Packager manicapital.com Rating [+ooooooooo] █░ █ Download URL [01/10] █░ █ █░ █ Release Type. █░ █ [ ] pATCH [X] sERIAL [ ] kEYGEN [ ] lOADER [ ] tUTORIAL [ ] oTHER █░ █ ░ ░ █░ █ ▒▒ ▒▒ █░ ▄ █▓▓░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▓▓█ ▄░ █ █▓▓▓▓▓▓▓▓▓▓▒▒▒▒▒▒░░░ rELEASE nOTES ! ░░░▒▒▒▒▒▒▓▓▓▓▓▓▓▓▓▓█ █ ▀ █▓▓░▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀░▓▓█ ▀░ █ ▒▒ manicapital.com ▒▒ █░ █ ░ ░ █░ █ █░ █ █░ █ ░ ░ █░ █ ▒▒ ▒▒ █░ ▄ █▓▓░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▓▓█ ▄░ █ █▓▓▓▓▓▓▓▓▓▓▒▒▒▒▒▒░░░ iNSTALL nOTES ! ░░░▒▒▒▒▒▒▓▓▓▓▓▓▓▓▓▓█ █ ▀ █▓▓░▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀░▓▓█ ▀░ █ ▒▒ 2PX48WT7 ▒▒ █░ █ ░ ░ █░ █ █░ █ █░ █ ░ ░ █░ █ ▒▒ ▒▒ █░ ▄ █▓▓░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▓▓█ ▄░ █ █▓▓▓▓▓▓▓▓▓▓▒▒▒▒▒▒░░░ gROUP nEWS ! ░░░▒▒▒▒▒▒▓▓▓▓▓▓▓▓▓▓█ █ ▀ █▓▓░▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀░▓▓█ ▀░ █ ▒▒ ▒▒ █░ █ ░ ░ █░ █ We welcome 4 new trial members. manicapital.com is now a distributor of █░ █ our quality releases. We hope on good connection for this year. nk________________________________: Cracker █░ █ NADA________________________________: Head Cracker █░ █ NaRRoW______________________________: Cracker █░ █ Nemesis_____________________________: Cracker █░ █ [email&#;protected]█░ █ Contact any OP in #tCA2k or [email&#;protected] █░ █ ░ ░ █░ █ ▒▒ ▒▒ █░ ▄ █▓▓░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▓▓█ ▄░ █ █▓▓▓▓▓▓▓▓▓▓▒▒▒▒▒▒░░░ aFFILIATES ░░░▒▒▒▒▒▒▓▓▓▓▓▓▓▓▓▓█ █ ▀ █▓▓░▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀░▓▓█ ▀░ █ ▒▒ ▒▒ █░ █ ░ ░ █░ █ █░ █ We are always looking for new fast (10Mb +) dumpsites. If you can █░ █ supply something of the above mentioned, than contact an op on █░ █ #tca2k in efnet or look at our contact list. █░ █ ░ ░ █░ █ ▒▒ ▒▒ █░ ▄ █▓▓░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▓▓█ ▄░ █ █▓▓▓▓▓▓▓▓▓▓▒▒▒▒▒▒░░░ cONTACT uS ! ░░░▒▒▒▒▒▒▓▓▓▓▓▓▓▓▓▓█ █ ▀ █▓▓░▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀░▓▓█ ▀░ █ ▒▒ ▒▒ █░ █ ░ ░ █░ █ Internet manicapital.com █░ █ EFNet #tCA2k █░ █ E-Mail [email&#;protected] █░ █ █░ █▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄█░ █Header : Speedy[SY!]░Layout : NoVa[TCA]░Last Update : 12/ by sEVanDo2k █░ ██████████████████████████████████████████████████████████████████████████████░ ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░ |

What’s New in the J-Perk 5.03 serial key or number?

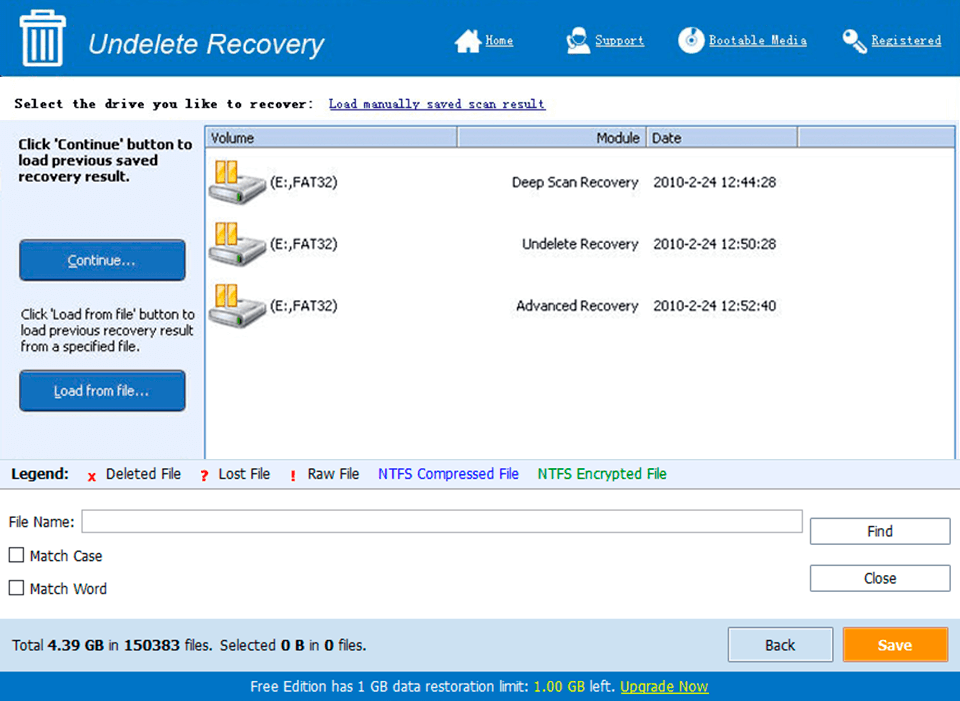

Screen Shot

System Requirements for J-Perk 5.03 serial key or number

- First, download the J-Perk 5.03 serial key or number

-

You can download its setup from given links: