Final Draft AV v2.5.2.53 serial key or number

Final Draft AV v2.5.2.53 serial key or number

Mountaineering Strategy to Excited States: Highly Accurate Energies and Benchmarks for Exotic Molecules and Radicals

Aiming at completing the sets of FCI-quality transition energies that we recently developed (J. Chem. Theory Comput.2018, 14, 4360–4379, ibid.2019, 15, 1939–1956, and ibid.2020, 16, 1711–1741), we provide, in the present contribution, ultra-accurate vertical excitation energies for a series of “exotic” closed-shell molecules containing F, Cl, P, and Si atoms and small radicals, such as CON and its variants, that were not considered to date in such investigations. This represents a total of 81 high-quality transitions obtained with a series of diffuse-containing basis sets of various sizes. For the exotic compounds, these transitions are used to perform benchmarks with a vast array of lower level models, i.e., CIS(D), EOM-MP2, (SOS/SCS)-CC2, STEOM-CCSD, CCSD, CCSDR(3), CCSDT-3, (SOS-)ADC(2), and ADC(3). Additional comparisons are made with literature data. For the open-shell compounds, we compared the performance of both the unrestricted and the restricted open-shell CCSD and CC3 formalisms.

January 2018

Preliminary Terms No. 149

Registration Statement Nos. 333-221595; 333-221595-01

Dated January 5, 2018

Filed pursuant to Rule 433

M S F LLC

Structured Investments

Opportunities in U.S. Equities

Contingent Income Auto-Callable Securities due January 15, 2021

Based on the Performance of the Common Stock of Valero Energy Corporation

Fully and Unconditionally Guaranteed by Morgan Stanley

Contingent Income Auto-Callable Securities do not guarantee the payment of interest or the repayment of principal. Instead, the securities offer the opportunity for investors to earn a contingent quarterly coupon at an annual rate of 8.25%, but only with respect to each determination date on which the determination closing price of the underlying stock is greater than or equal to 80% of the initial share price, which we refer to as the downside threshold price. In addition, if the determination closing price of the underlying stock is greater than or equal to the initial share price on any determination date, the securities will be automatically redeemed for an amount per security equal to the stated principal amount and the contingent quarterly coupon. However, if the securities are not automatically redeemed prior to maturity, the payment at maturity due on the securities will be as follows: (i) if the final share price is greater than or equal to the downside threshold price, the stated principal amount and the contingent quarterly coupon with respect to the final determination date, or (ii) if the final share price is less than the downside threshold price, investors will be exposed to the decline in the underlying stock on a 1-to-1 basis and will receive a payment at maturity that is less than 80% of the principal amount of the securities and could be zero. Moreover, if on any determination date the determination closing price of the underlying stock is less than the downside threshold price, you will not receive any contingent quarterly coupon for that quarterly period. As a result, investors must be willing to accept the risk of not receiving any contingent quarterly coupons and also the risk of receiving a payment at maturity that is significantly less than the stated principal amount of the securities and could be zero. Accordingly, investors could lose their entire initial investment in the securities. The securities are for investors who are willing to risk their principal and seek an opportunity to earn interest at a potentially above-market rate in exchange for the risk of receiving few or no contingent quarterly coupons over the 3-year term of the securities. Investors will not participate in any appreciation of the underlying stock. The securities are unsecured obligations of Morgan Stanley Finance LLC (“MSFL”) and are fully and unconditionally guaranteed by Morgan Stanley. The securities are issued as part of MSFL’s Series A Global Medium-Term Notes program.

All payments are subject to our credit risk. If we default on our obligations, you could lose some or all of your investment. These securities are not secured obligations and you will not have any security interest in, or otherwise have any access to, any underlying reference asset or assets.

The securities involve risks not associated with an investment in ordinary debt securities. See “Risk Factors” beginning on page 7.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this document or the accompanying product supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The securities are not deposits or savings accounts and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality, nor are they obligations of, or guaranteed by, a bank.

You should read this document together with the related product supplement and prospectus, each of which can be accessed via the hyperlinks below. Please also see “Additional Information About the Securities” at the end of this document.

As used in this document, “we,” “us” and “our” refer to Morgan Stanley or MSFL, or Morgan Stanley and MSFL collectively, as the context requires.

Product Supplement for Auto-Callable Securities dated November 16, 2017 Prospectus dated November 16, 2017

M S F LLC

Contingent Income Auto-Callable Securities due January 15, 2021

Based on the Performance of the Common Stock of Valero Energy Corporation

Investment Summary

Contingent Income Auto-Callable Securities

Principal at Risk Securities

The Contingent Income Auto-Callable Securities due January 15, 2021 Based on the Performance of the Common Stock of Valero Energy Corporation, which we refer to as the securities, provide an opportunity for investors to earn a contingent quarterly coupon at an annual rate of 8.25% with respect to each quarterly determination date on which the determination closing price or the final share price, as applicable, is greater than or equal to 80% of the initial share price, which we refer to as the downside threshold price. It is possible that the closing price of the underlying stock could remain below the downside threshold price for extended periods of time or even throughout the term of the securities so that you may receive few or no contingent quarterly coupons. If the determination closing price is greater than or equal to the initial share price on any of the first eleven determination dates, the securities will be automatically redeemed for an early redemption payment equal to the stated principal amount plus the contingent quarterly coupon with respect to the related determination date. If the securities have not previously been redeemed and the final share price is greater than or equal to the downside threshold price, the payment at maturity will also be the sum of the stated principal amount and the contingent quarterly coupon with respect to the related determination date. However, if the securities have not previously been redeemed and the final share price is less than the downside threshold price, investors will be exposed to the decline in the closing price of the underlying stock, as compared to the initial share price, on a 1-to-1 basis. In this case, the payment at maturity will be less than 80% of the stated principal amount of the securities and could be zero. Investors in the securities must be willing to accept the risk of losing their entire principal and also the risk of not receiving any contingent quarterly coupon. In addition, investors will not participate in any appreciation of the underlying stock.

The original issue price of each security is $10. This price includes costs associated with issuing, selling, structuring and hedging the securities, which are borne by you, and, consequently, the estimated value of the securities on the pricing date will be less than $10. We estimate that the value of each security on the pricing date will be approximately $9.626, or within $0.225 of that estimate. Our estimate of the value of the securities as determined on the pricing date will be set forth in the final pricing supplement.

What goes into the estimated value on the pricing date?

In valuing the securities on the pricing date, we take into account that the securities comprise both a debt component and a performance-based component linked to the underlying stock. The estimated value of the securities is determined using our own pricing and valuation models, market inputs and assumptions relating to the underlying stock, instruments based on the underlying stock, volatility and other factors including current and expected interest rates, as well as an interest rate related to our secondary market credit spread, which is the implied interest rate at which our conventional fixed rate debt trades in the secondary market.

What determines the economic terms of the securities?

In determining the economic terms of the securities, including the contingent quarterly coupon rate and the downside threshold price, we use an internal funding rate, which is likely to be lower than our secondary market credit spreads and therefore advantageous to us. If the issuing, selling, structuring and hedging costs borne by you were lower or if the internal funding rate were higher, one or more of the economic terms of the securities would be more favorable to you.

What is the relationship between the estimated value on the pricing date and the secondary market price of the securities?

The price at which MS & Co. purchases the securities in the secondary market, absent changes in market conditions, including those related to the underlying stock, may vary from, and be lower than, the estimated value on the pricing date, because the secondary market price takes into account our secondary market credit spread as well as the bid-offer spread that MS & Co. would charge in a secondary market transaction of this type and other factors. However, because the costs associated with issuing, selling, structuring and hedging the securities are not fully deducted upon issuance, for a period of up to 6 months following the issue date, to the extent that MS & Co. may buy or sell the securities in the secondary market, absent changes in market conditions, including those related to the underlying stock, and to our secondary market credit spreads, it would do so based on values higher than the estimated value. We expect that those higher values will also be reflected in your brokerage account statements.

MS & Co. may, but is not obligated to, make a market in the securities, and, if it once chooses to make a market, may cease doing so at any time.

M S F LLC

Contingent Income Auto-Callable Securities due January 15, 2021

Based on the Performance of the Common Stock of Valero Energy Corporation

Key Investment Rationale

The securities offer investors an opportunity to earn a contingent quarterly coupon at an annual rate of 8.25% with respect to each determination date on which the determination closing price or the final share price, as applicable, is greater than or equal to 80% of the initial share price, which we refer to as the downside threshold price. The securities may be redeemed prior to maturity for the stated principal amount per security plus the applicable contingent quarterly coupon, and the payment at maturity will vary depending on the final share price, as follows:

| Scenario 1 | On any of the first eleven determination dates, the determination closing price is greater than or equal to the initial share price.

The securities will be automatically redeemed for (i) the stated principal amount plus (ii) the contingent quarterly coupon with respect to the related determination date.

Investors will not participate in any appreciation of the underlying stock from the initial share price.

|

| Scenario 2 | The securities are not automatically redeemed prior to maturity, and the final share price is greater than or equal to the downside threshold price.

The payment due at maturity will be (i) the stated principal amount plus (ii) the contingent quarterly coupon with respect to the final determination date.

Investors will not participate in any appreciation of the underlying stock from the initial share price.

|

| Scenario 3 | The securities are not automatically redeemed prior to maturity, and the final share price is less than the downside threshold price.

The payment due at maturity will be equal to (i) the stated principal amount multiplied by (ii) the share performance factor. Investors will lose a significant portion, and may lose all, of their principal in this scenario. |

M S F LLC

Contingent Income Auto-Callable Securities due January 15, 2021

Based on the Performance of the Common Stock of Valero Energy Corporation

How the Securities Work

The following diagrams illustrate the potential outcomes for the securities depending on (1) the determination closing price and (2) the final share price.

Diagram #1: First Eleven Determination Dates

Diagram #2: Payment at Maturity if No Automatic Early Redemption Occurs

M S F LLC

Contingent Income Auto-Callable Securities due January 15, 2021

Based on the Performance of the Common Stock of Valero Energy Corporation

Hypothetical Examples

The below examples are based on the following terms:

| Hypothetical Initial Share Price: | $90.00 |

| Hypothetical Downside Threshold Price: | $72.00, which is 80% of the hypothetical initial share price |

| Hypothetical Adjustment Factor: | 1.0 |

| Contingent Quarterly Coupon: | 8.25% per annum (corresponding to approximately $0.20625 per quarter per security)1 |

| Stated Principal Amount: | $10 per security |

1 The actual contingent quarterly coupon will be an amount determined by the calculation agent based on the number of days in the applicable payment period, calculated on a 30/360 day count basis. The hypothetical contingent quarterly coupon of $0.20625 is used in these examples for ease of analysis.

In Examples 1 and 2, the closing price of the underlying stock fluctuates over the term of the securities and the determination closing price of the underlying stock is greater than or equal to the hypothetical initial share price of $90.00 on one of the first eleven determination dates. Because the determination closing price is greater than or equal to the initial share price on one of the first eleven determination dates, the securities are automatically redeemed following the relevant determination date. In Examples 3 and 4, the determination closing price on the first eleven determination dates is less than the initial share price, and, consequently, the securities are not automatically redeemed prior to, and remain outstanding until, maturity.

| Example 1 | Example 2 | |||||

| Determination Dates | Hypothetical Determination Closing Price | Contingent Quarterly Coupon | Early Redemption Amount* | Hypothetical Determination Closing Price | Contingent Quarterly Coupon | Early Redemption Amount |

| #1 | $66.35 | $0 | N/A | $84.45 | $0.20625 | N/A |

| #2 | $90.00 | —* | $10.20625 | $71.55 | $0 | N/A |

| #3 | N/A | N/A | N/A | $75.45 | $0.20625 | N/A |

| #4 | N/A | N/A | N/A | $54.55 | $0 | N/A |

| #5 | N/A | N/A | N/A | $87.35 | $0.20625 | N/A |

| #6 | N/A | N/A | N/A | $79.80 | $0.20625 | N/A |

| #7 | N/A | N/A | N/A | $55.10 | $0 | N/A |

| #8 | N/A | N/A | N/A | $80.45 | $0.20625 | N/A |

| #9 | N/A | N/A | N/A | $83.75 | $0.20625 | N/A |

| #10 | N/A | N/A | N/A | $108.00 | —* | $10.20625 |

| #11 | N/A | N/A | N/A | N/A | N/A | N/A |

| Final Determination Date | N/A | N/A | N/A | N/A | N/A | N/A |

* The Early Redemption Amount includes the unpaid contingent quarterly coupon with respect to the determination date on which the determination closing price is greater than or equal to the initial share price and the securities are redeemed as a result.

In Example 1, the securities are automatically redeemed following the second determination date, as the determination closing price on the second determination date is equal to the initial share price. You receive the early redemption payment, calculated as follows:

stated principal amount + contingent quarterly coupon = $10.00 + $0.20625 = $10.20625

In this example, the early redemption feature limits the term of your investment to approximately 6 months, and you may not be able to reinvest at comparable terms or returns. If the securities are redeemed early, you will stop receiving contingent coupons.

In Example 2, the securities are automatically redeemed following the tenth determination date, as the determination closing price on the tenth determination date is greater than the initial share price. As the determination closing prices on the first, third, fifth, sixth, eighth, ninth and tenth determination dates are greater than or equal to the downside threshold price, you receive the contingent

M S F LLC

Contingent Income Auto-Callable Securities due January 15, 2021

Based on the Performance of the Common Stock of Valero Energy Corporation

coupon of $0.20625 with respect to each such determination date. Following the tenth determination date, you receive an early redemption amount of $10.20625, which includes the contingent quarterly coupon with respect to the tenth determination date.

In this example, the early redemption feature limits the term of your investment to approximately 30 months, and you may not be able to reinvest at comparable terms or returns. If the securities are redeemed early, you will stop receiving contingent coupons. Further, although the underlying stock has appreciated by 20% from its initial share price as of the tenth determination date, you receive only $10.20625 per security and do not benefit from such appreciation.

| Example 3 | Example 4 | |||||

| Determination Dates | Hypothetical Determination Closing Price / Final Share Price | Contingent Quarterly Coupon | Early Redemption Amount* | Hypothetical Determination Closing Price / Final Share Price | Contingent Quarterly Coupon | Early Redemption Amount |

| #1 | $66.35 | $0 | N/A | $48.45 | $0 | N/A |

| #2 | $71.55 | $0 | N/A | $57.45 | $0 | N/A |

| #3 | $54.55 | $0 | N/A | $60.35 | $0 | N/A |

| #4 | $52.80 | $0 | N/A | $55.10 | $0 | N/A |

| #5 | $53.45 | $0 | N/A | $56.75 | $0 | N/A |

| #6 | $58.15 | $0 | N/A | $68.40 | $0 | N/A |

| #7 | $49.55 | $0 | N/A | $52.60 | $0 | N/A |

| #8 | $53.70 | $0 | N/A | $54.20 | $0 | N/A |

| #9 | $62.95 | $0 | N/A | $57.85 | $0 | N/A |

| #10 | $48.40 | $0 | N/A | $53.45 | $0 | N/A |

| #11 | $49.35 | $0 | N/A | $64.90 | $0 | N/A |

| Final Determination Date | $54.00 | $0 | N/A | $81.00 | —* | N/A |

| Payment at Maturity | $6.00 | $10.20625 | ||||

*The final contingent quarterly coupon, if any, will be paid at maturity.

Examples 3 and 4 illustrate the payment at maturity per security based on the final share price.

In Example 3, the closing price of the underlying stock remains below the downside threshold price on every determination date. As a result, you do not receive any contingent coupons during the term of the securities and, at maturity, you are fully exposed to the decline in the closing price of the underlying stock. As the final share price is less than the downside threshold price, investors will receive a payment at maturity equal to the stated principal amount multiplied by the share performance factor, calculated as follows:

stated principal amount x share performance factor = $10.00 x ($54.00 / $90.00) = $6.00

In this example, the payment at maturity is significantly less than the stated principal amount.

In Example 4, the closing price of the underlying stock decreases to a final share price of $81.00. Although the final share price is less than the initial share price, because the final share price is still not less than the downside threshold price, you receive the stated principal amount plus a contingent quarterly coupon with respect to the final determination date. Your payment at maturity is calculated as follows:

$10.00 + $0.20625 = $10.20625

In this example, although the final share price represents a 10% decline from the initial share price, you receive the stated principal amount per security plus the final contingent quarterly coupon, equal to a total payment of $10.20625 per security at maturity, because the final share price is not less than the downside threshold price.

M S F LLC

Contingent Income Auto-Callable Securities due January 15, 2021

Based on the Performance of the Common Stock of Valero Energy Corporation

Risk Factors

The following is a non-exhaustive list of certain key risk factors for investors in the securities. For further discussion of these and other risks, you should read the section entitled “Risk Factors” in the accompanying product supplement and prospectus. You should also consult your investment, legal, tax, accounting and other advisers in connection with your investment in the securities.

| The securities do not guarantee the return of any principal. The terms of the securities differ from those of ordinary debt securities in that the securities do not guarantee the payment of regular interest or the return of any of the principal amount at maturity. Instead, if the securities have not been automatically redeemed prior to maturity and if the final share price is less than the downside threshold price, you will be exposed to the decline in the closing price of the underlying stock, as compared to the initial share price, on a 1-to-1 basis and you will receive a payment that will be less than 80% of the stated principal amount and could be zero. |

| You will not receive any contingent quarterly coupon for any quarterly period where the determination closing price is less than the downside threshold price. A contingent quarterly coupon will be paid with respect to a quarterly period only if the determination closing price is greater than or equal to the downside threshold price. If the determination closing price remains below the downside threshold price on each determination date over the term of the securities, you will not receive any contingent quarterly coupons. |

| The contingent quarterly coupon, if any, is based solely on the determination closing price or the final share price, as applicable. Whether the contingent quarterly coupon will be paid with respect to a determination date will be based on the determination closing price or the final share price, as applicable. As a result, you will not know whether you will receive the contingent quarterly coupon until the related determination date. Moreover, because the contingent quarterly coupon is based solely on the determination closing price on a specific determination date or the final share price, as applicable, if such determination closing price or final share price is less than the downside threshold price, you will not receive any contingent quarterly coupon with respect to such determination date, even if the closing price of the underlying stock was higher on other days during the term of the securities. |

| Investors will not participate in any appreciation in the price of the underlying stock. Investors will not participate in any appreciation in the price of the underlying stock from the initial share price, and the return on the securities will be limited to the contingent quarterly coupon, if any, that is paid with respect to each determination date on which the determination closing price or the final share price, as applicable, is greater than or equal to the downside threshold price. It is possible that the closing price of the underlying stock could be below the downside threshold price on most or all of the determination dates so that you will receive few or no contingent quarterly coupons. If you do not earn sufficient contingent quarterly coupons over the term of the securities, the overall return on the securities may be less than the amount that would be paid on a conventional debt security of ours of comparable maturity. |

| The automatic early redemption feature may limit the term of your investment to approximately three months. If the securities are redeemed early, you may not be able to reinvest at comparable terms or returns. The term of your investment in the securities may be limited to as short as approximately three months by the automatic early redemption feature of the securities. If the securities are redeemed prior to maturity, you will receive no more contingent quarterly coupons and may be forced to invest in a lower interest rate environment and may not be able to reinvest at comparable terms or returns. |

| The market price will be influenced by many unpredictable factors. Several factors will influence the value of the securities in the secondary market and the price at which MS & Co. may be willing to purchase or sell the securities in the secondary market. Although we expect that generally the closing price of the underlying stock on any day will affect the value of the securities more than any other single factor, other factors that may influence the value of the securities include: |

| the trading price and volatility (frequency and magnitude of changes in value) of the underlying stock, |

| whether the determination closing price has been below the downside threshold price on any determination date, |

| dividend rates on the underlying stock, |

| interest and yield rates in the market, |

| time remaining until the securities mature, |

| geopolitical conditions and economic, financial, political, regulatory or judicial events that affect the underlying stock and which may affect the final share price of the underlying stock, |

| the occurrence of certain events affecting the underlying stock that may or may not require an adjustment to the adjustment factor, and |

M S F LLC

Contingent Income Auto-Callable Securities due January 15, 2021

Based on the Performance of the Common Stock of Valero Energy Corporation

| any actual or anticipated changes in our credit ratings or credit spreads. |

The price of the underlying stock may be, and has recently been, volatile, and we can give you no assurance that the volatility will lessen. See “Valero Energy Corporation Overview” below. You may receive less, and possibly significantly less, than the stated principal amount per security if you try to sell your securities prior to maturity.

| The securities are subject to our credit risk, and any actual or anticipated changes to our credit ratings or credit spreads may adversely affect the market value of the securities. You are dependent on our ability to pay all amounts due on the securities on each contingent payment date, upon automatic redemption or at maturity, and therefore you are subject to our credit risk. If we default on our obligations under the securities, your investment would be at risk and you could lose some or all of your investment. As a result, the market value of the securities prior to maturity will be affected by changes in the market’s view of our creditworthiness. Any actual or anticipated decline in our credit ratings or increase in the credit spreads charged by the market for taking our credit risk is likely to adversely affect the market value of the securities. |

| As a finance subsidiary, MSFL has no independent operations and will have no independent assets. As a finance subsidiary, MSFL has no independent operations beyond the issuance and administration of its securities and will have no independent assets available for distributions to holders of MSFL securities if they make claims in respect of such securities in a bankruptcy, resolution or similar proceeding. Accordingly, any recoveries by such holders will be limited to those available under the related guarantee by Morgan Stanley and that guarantee will rank pari passu with all other unsecured, unsubordinated obligations of Morgan Stanley. Holders will have recourse only to a single claim against Morgan Stanley and its assets under the guarantee. Holders of securities issued by MSFL should accordingly assume that in any such proceedings they would not have any priority over and should be treated pari passu with the claims of other unsecured, unsubordinated creditors of Morgan Stanley, including holders of Morgan Stanley-issued securities. |

| Investing in the securities is not equivalent to investing in the common stock of Valero Energy Corporation. Investors in the securities will not have voting rights or rights to receive dividends or other distributions or any other rights with respect to the underlying stock. |

| No affiliation with Valero Energy Corporation. Valero Energy Corporation is not an affiliate of ours, is not involved with this offering in any way, and has no obligation to consider your interests in taking any corporate actions that might affect the value of the securities. We have not made any due diligence inquiry with respect to Valero Energy Corporation in connection with this offering. |

| We may engage in business with or involving Valero Energy Corporation without regard to your interests. We or our affiliates may presently or from time to time engage in business with Valero Energy Corporation without regard to your interests and thus may acquire non-public information about Valero Energy Corporation. Neither we nor any of our affiliates undertakes to disclose any such information to you. In addition, we or our affiliates from time to time have published and in the future may publish research reports with respect to Valero Energy Corporation, which may or may not recommend that investors buy or hold the underlying stock. |

| The antidilution adjustments the calculation agent is required to make do not cover every corporate event that could affect the underlying stock. |

PpWe recommend bSurfsharkVPNb as it provides you the best protection, blazing-fast streaming speeds, and no limits on simultaneous connections for as little as strong1. 99 per monthstrong. ph3Are Android Emulators safe?h3pYes, Android emulators are entirely safe to use as long as you download them from their official websites.

.What’s New in the Final Draft AV v2.5.2.53 serial key or number?

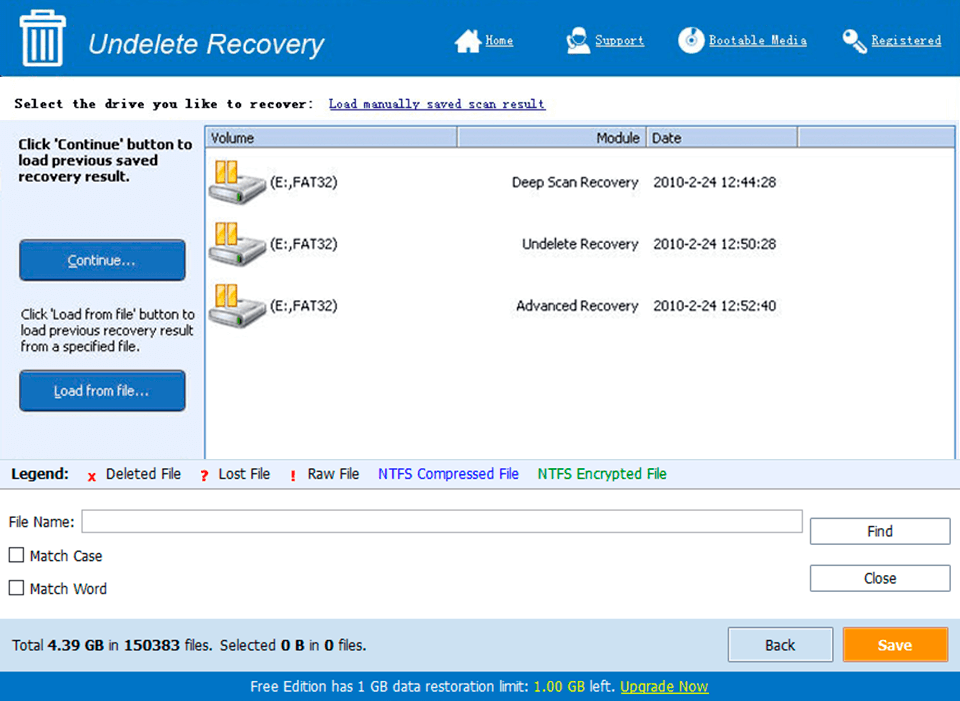

Screen Shot

System Requirements for Final Draft AV v2.5.2.53 serial key or number

- First, download the Final Draft AV v2.5.2.53 serial key or number

-

You can download its setup from given links: